Stop Leaving Thousands on the Table...Learn the Tax Strategies Your CPA Isn’t Telling You About.

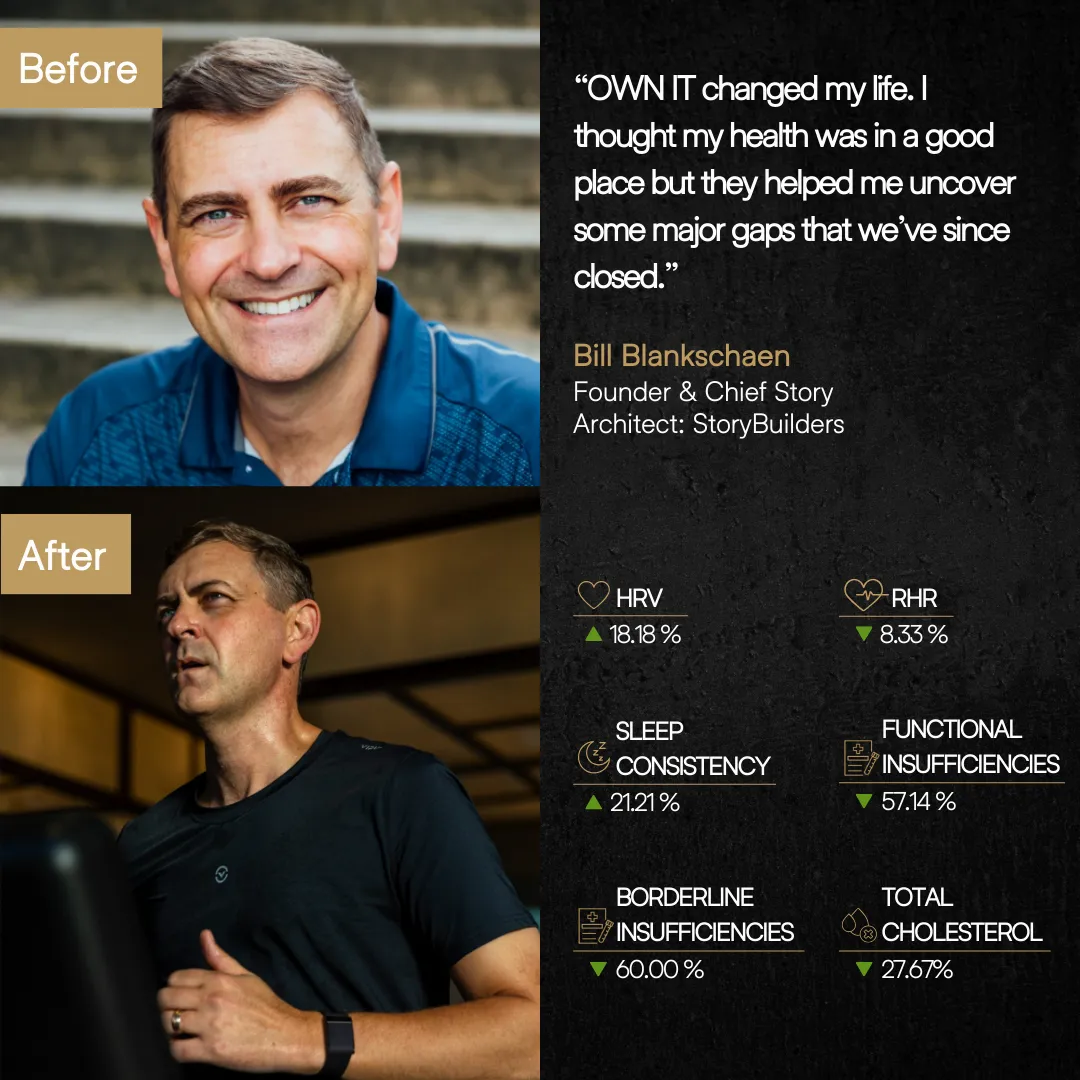

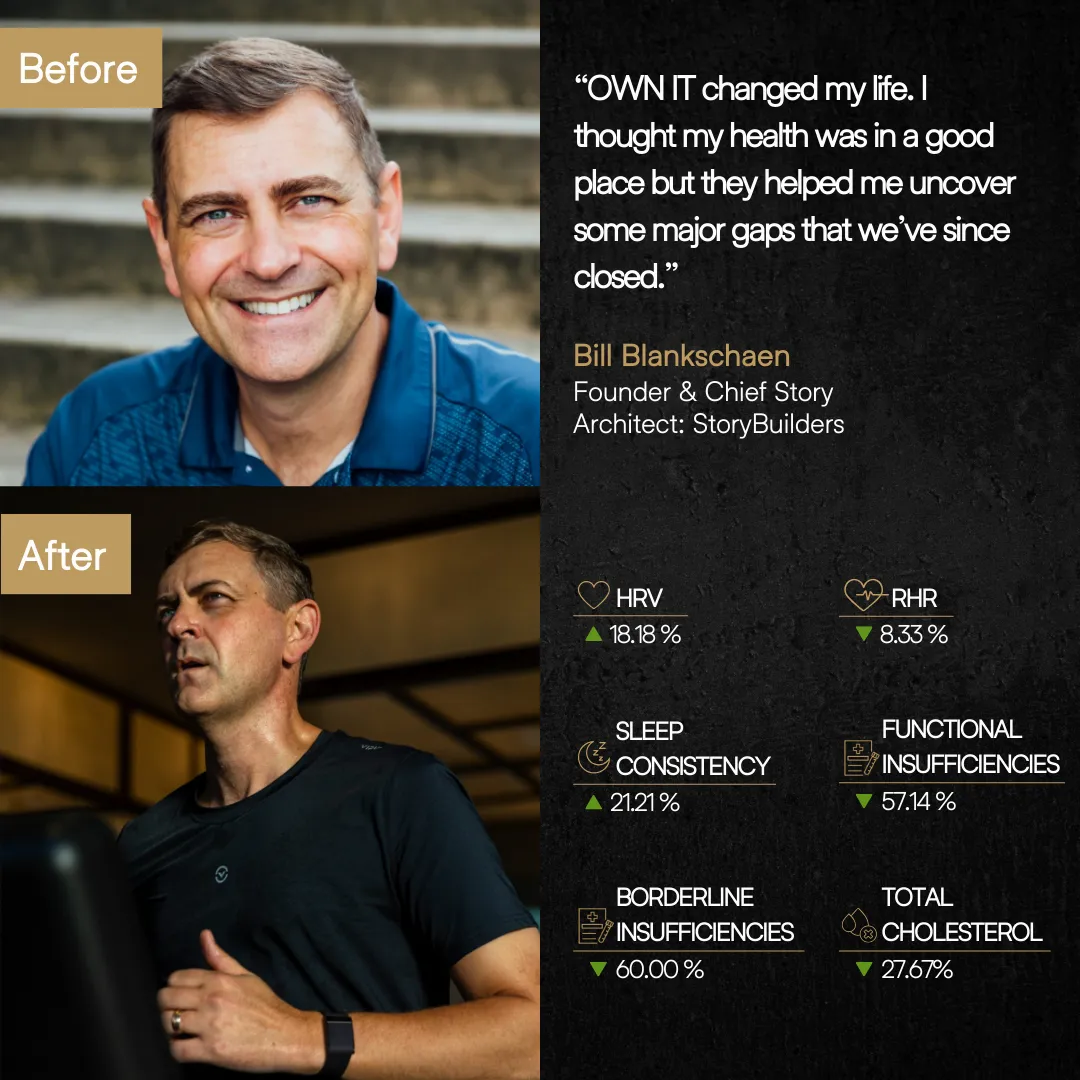

Your Health is Your Greatest Asset

Stop Treating It Like a Liability

Discover the Proven System High-Performers Use to Reclaim Their Energy and Crush Burnout.

Learn YOUR Blueprint: Get a personalized blueprint for your health based on your unique blood work.

Reclaim Your Energy: Finally feel in control of your energy, focus, and performance with a system built for high-achievers.

Personalize Your Routine: Unlock a workout plan designed specifically for your goals, lifestyle, and body type.

Boost Your Bottom Line: Keep more of your hard-earned profits in your pocket—legally and ethically.

Peace of Mind: No more second-guessing your workouts — know you're always on the right track.

Uncover Missed Tax Opportunities:

Get a tailored checklist of tax strategies designed specifically for your business.

Save Time and Reduce Stress:

Let our team handle the heavy lifting while you focus on growing your business.

Proactive Tax Planning:

Stay ahead of the IRS with quarterly strategy updates that evolve as your business grows.

Boost Your Bottom Line:

Keep more of your hard-earned profits in your pocket—legally and ethically.

Peace of Mind: Never worry about surprise tax bills or penalties again.

As Seen In

Trusted by Hundreds of Business Owners:

Ready to Keep More of Your Hard-Earned Profits?

No commitment required—just a quick call to see if we’re the right fit for your business.

Every day you delay implementing these strategies, you’re leaving money on the table—and the longer you wait, the harder it becomes to recover those losses.

Let us help you stop the bleeding and start saving today.

How is this different from what my CPA already does?

Most CPAs focus on filing tax returns for past events. Our team creates forward-looking tax strategies that legally reduce your tax burden. We don't just record history - we help you write a different financial future with advanced planning most CPAs taught about.

Will these strategies work for my specific type of business?

Yes. We've successfully implemented these strategies across virtually every industry. Whether you're in e-commerce, real estate, consulting, or brick-and-mortar retail, these tax strategies work because they're based on tax code, not industry type.

How long does it take to see results from these tax strategies?

Individual results will vary. Some strategies deliver immediate benefits, while others show their full impact at tax filing time. You'll receive a clear timeline during your strategy session.

What’s the process like? Is it complicated or time-consuming?

We've simplified everything. After your initial strategy session, you'll receive a custom plan with clear action steps. Our team handles the complex parts while you focus on running your business. Our systems are designed to save you time — and our team does the prep work so you don’t have to.

Is this legal? Will I get audited if I use these strategies?

Every strategy we recommend is 100% legal and compliant with current tax code. These aren't gray-area loopholes - they're established provisions the wealthy have used for decades. Our approach actually reduces audit risk by ensuring proper documentation and compliance.

What kind of support do I get if I have questions or need help?

You receive unlimited email support, direct access to tax strategists, quarterly review sessions, and annual strategy updates. We're with you every step of the way to ensure successful implementation and maximum savings.

What’s the cost, and is there a guarantee?

There’s no one-size-fits-all pricing — it depends on your structure and goals. But in many cases, the savings more than justify the investment.

Every day you wait, you’re losing money

that could’ve stayed in your pocket.

The longer you wait, the harder it becomes to recover those losses—and the less we can do to maximize your savings.

Don’t wait until it’s too late to take control of your taxes. Book your free call now and start keeping more of what you earn.

This site is not a part of the Facebook website or Facebook Inc. Additionally, this site is not endorsed by

Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

Copyright ©. All Rights Reserved.

IMPORTANT: Earnings and Legal Disclaimers

We believe in sustainable growth through expertise, value creation, and exceptional client service—principles that guide all our work. As required by law, we cannot and do not make guarantees about individual results or earnings potential with our strategies, insights, or frameworks. Your outcomes depend on various factors unique to your situation. We're committed to providing sophisticated strategies to accelerate your progress, while acknowledging that any financial references on our platforms represent estimates, projections, or historical results—not promises of future performance. These figures are purely illustrative. Thank you for your consideration.

We're honored to be part of your journey and are committed to helping you streamline your tax strategy and build a stronger foundation for your practice.